CPF withdrawal refers to the entire process of using out funds from one particular's Central Provident Fund (CPF) account in Singapore. The CPF is a mandatory cost savings scheme for working persons in Singapore to set aside resources for retirement, healthcare, and housing requirements. There are many conditions under which CPF customers could make withdrawals as in-depth under:

Kinds of CPF Withdrawals:

Retirement:

On achieving the eligibility age (at the moment fifty five a long time aged), CPF associates can withdraw their CPF savings.

The Retirement Sum Scheme permits month-to-month payouts when maintaining a least sum within the Retirement Account.

Housing:

Cash within the Regular Account may be used for housing-related needs which include downpayment, mortgage loan repayment, or obtaining assets.

Healthcare:

Specific clinical conditions or hospitalizations could qualify for Medisave withdrawal to protect medical expenditures.

Schooling:

CPF Education and learning Plan will allow withdrawing resources for tertiary education charges and accepted programs.

Financial commitment:

Users with much more than The essential Retirement Sum may invest their excess resources in check here the CPF Investment Plan.

Coverage:

Rates for selected lifetime insurance plan procedures might be paid out making use of CPF Normal Account funds.

Leaving Singapore/Long-lasting Residency:

When leaving Singapore forever, non-PRs can withdraw their CPF balances soon after immigration clearance.

Crucial Points to notice:

Differing types of withdrawals have varying eligibility conditions and boundaries determined by particular requirements.

Early withdrawals right before retirement age are subject matter to limitations and penalties.

Certain withdrawals have to have supporting documentation or approval from relevant authorities.

Unused CPF discounts proceed earning interest until eventually withdrawn or transferred to some retirement account.

In summary, knowing the varied sorts of cpf withdrawals readily available is essential for maximizing benefits and scheduling proficiently for foreseeable future economic needs in retirement, healthcare, housing, education, and various vital costs in the course of distinct levels of lifestyle in Singapore.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Barbi Benton Then & Now!

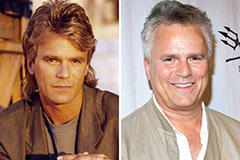

Barbi Benton Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!